Financial Lessons From Historical Economic Crises

4 min read

The financial crisis was an international event, but effective policy responses helped prevent its worsening and an economic catastrophe comparable to that of the Great Depression. Although innovative financing for mortgage loans and securities contributed to its onset, those innovations alone did not cause it.

Conventional wisdom holds that the source of the global financial crisis lies with the United States and other traditional industrial nations. Yet conventional wisdom is false in two respects.

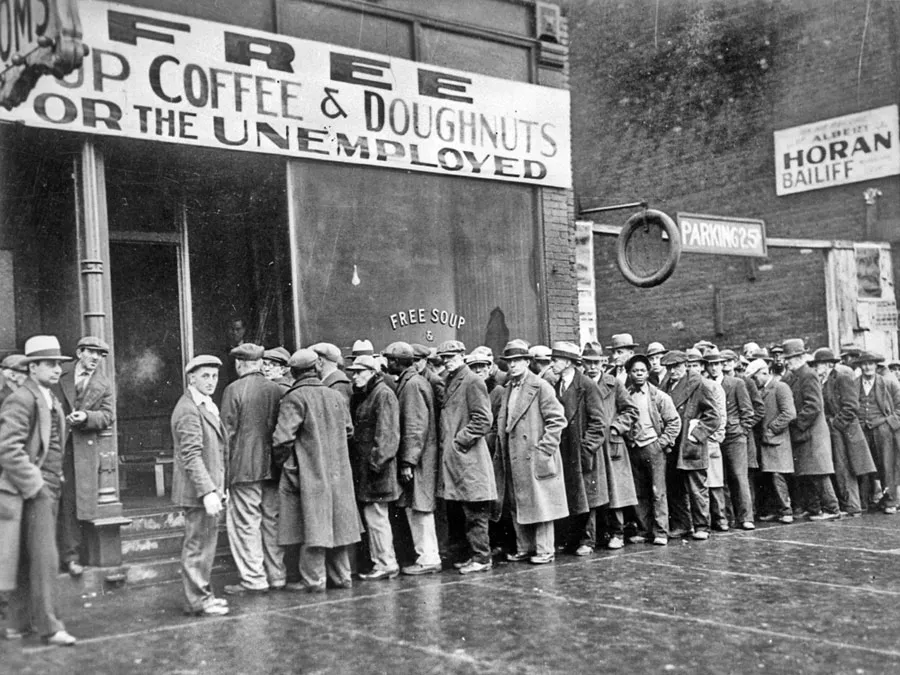

The Great Depression

The Great Depression was one of the largest and longest economic contractions in modern world history, precipitated by several financial crises including 1929’s stock market crash and bank panics in 1930 and 1931. Industrial output had collapsed while unemployment levels had skyrocketed when President Franklin Delano Roosevelt took office, and by this point industrial output had collapsed while unemployment had skyrocketed even further.

The Great Depression taught us an invaluable lesson about debt. After World War I, the economy boomed rapidly and people quickly found themselves incurring debt in order to purchase items like refrigerators and radios; some even borrowed money to invest. When the Depression hit, many debt payments proved too much for many people while those without loans managed better through it all.

Lessons from the Great Depression should also teach us about diversifying investments. When the stock market collapsed in 1929, government bonds provided investors with safety. If your portfolio were more diverse than it would have been easier for the Great Depression not to wipe out your wealth so easily.

The Great Depression taught us an invaluable lesson: the necessity of saving for an emergency. People who survived were able to avoid debt by living within their means, budgeting down to every penny, and spending no more than they earned. Furthermore, they saved for rainy day emergencies allowing them to live off savings during difficult periods like this one.

The Great Recession

The global economic downturn brought on by the 2008 financial crisis lasted from late 2007 until June 2009. It was the longest recession since the Great Depression and resulted in massive reductions of world GDP as well as debt crises for some of the world’s major economies. Within the United States alone, home prices sharply declined while millions of homeowners found themselves with mortgages that cost more than their properties were worth.

Consumer confidence dipped, making it harder for businesses to sell their products and services. Some major corporations like General Motors and Chrysler had to seek government bailouts or merge with other firms; and portfolios held by some prestigious banks and investment firms were revealed as holding worthless “toxic assets.”

One key lesson from the Great Recession was how debt affected people’s financial flexibility. People in debt often lost jobs and homes; even those who maintained employment struggled to make ends meet due to debt payments.

Diversifying investments is also an essential lesson from the Great Recession. After its impact, many investors changed their habits to focus on cash or fixed income investments in an attempt to lessen their exposure to volatile stock markets.

The Coronavirus Crisis

The Coronavirus Crisis is an economic-based crisis unlike any others seen before; its nature has altered how B2B firms operate during times of distress, necessitating an entirely different mindset to effectively navigate it.

This global outbreak caused by C-VARI, a highly infectious strain of coronavirus, has created an unprecedented financial crisis for individuals and organisations worldwide. While 2008’s financial meltdown was caused by mortgage-backed securities, this outbreak stems from human-to-human transmission of disease.

This economic crisis is leading to income losses for households and companies alike, disruption in supply chains, decreased investment and spending by both businesses and consumers, and an erosion of confidence lasting years – yet its lessons learned in past economic crises still apply today.

At first, it is crucial to live within your means and avoid debt during times of economic uncertainty, while saving funds in an emergency savings account or life insurance will provide protection from potential medical expenses draining finances. Furthermore, taking part in recommended vaccinations will better equip you to deal with future economic or health-related crises that might impact finances.

The Financial Crisis

In September 2008, Lehman Brothers’ collapse initiated a global financial crisis which resulted in lending being frozen up, many institutions being required to be rescued, share market falls of 50% plus and an unprecedented postwar global economic contraction. This event was caused by policies of low interest rates which enabled banks to make loans they should not have made and created an unprecedented housing bubble that burst and resulted in market and company collapse.

British economy suffered greatly as its domino effect rippled from New York to Liverpool and Glasgow. To prevent further financial disaster, Bank of England provided funds directly to struggling lenders as well as directly to firms in need through bail-out packages that later became the model for crisis-mode central banking policies such as those implemented under Bagehot’s guidance.

This bail-out successfully restored confidence, ending the “Great Recession.” Additionally, it established a pattern of bailouts which has persisted ever since – prompting increased global regulation requiring banks to assess loan risk more closely while using more resilient funding sources; further leading to reduction in bank size as larger firms acquired smaller rivals.

Financial crises provide us with numerous lessons about financial planning and investment that have significant ramifications, including the value of creating an appropriate contingency plan, communicating effectively with clients and being ready for difficult discussions when times become challenging.